Tax Resources

Feel lost when it comes to taxes? Most of us do. And, since the nuances of taxes change each year, it’s hard to know what to do each year. Luckily, you’re not alone! The Project LIFE team has pulled together a few general resources to get your brain wrapped around it all, including a session that you can virtually attend. Read on for help.

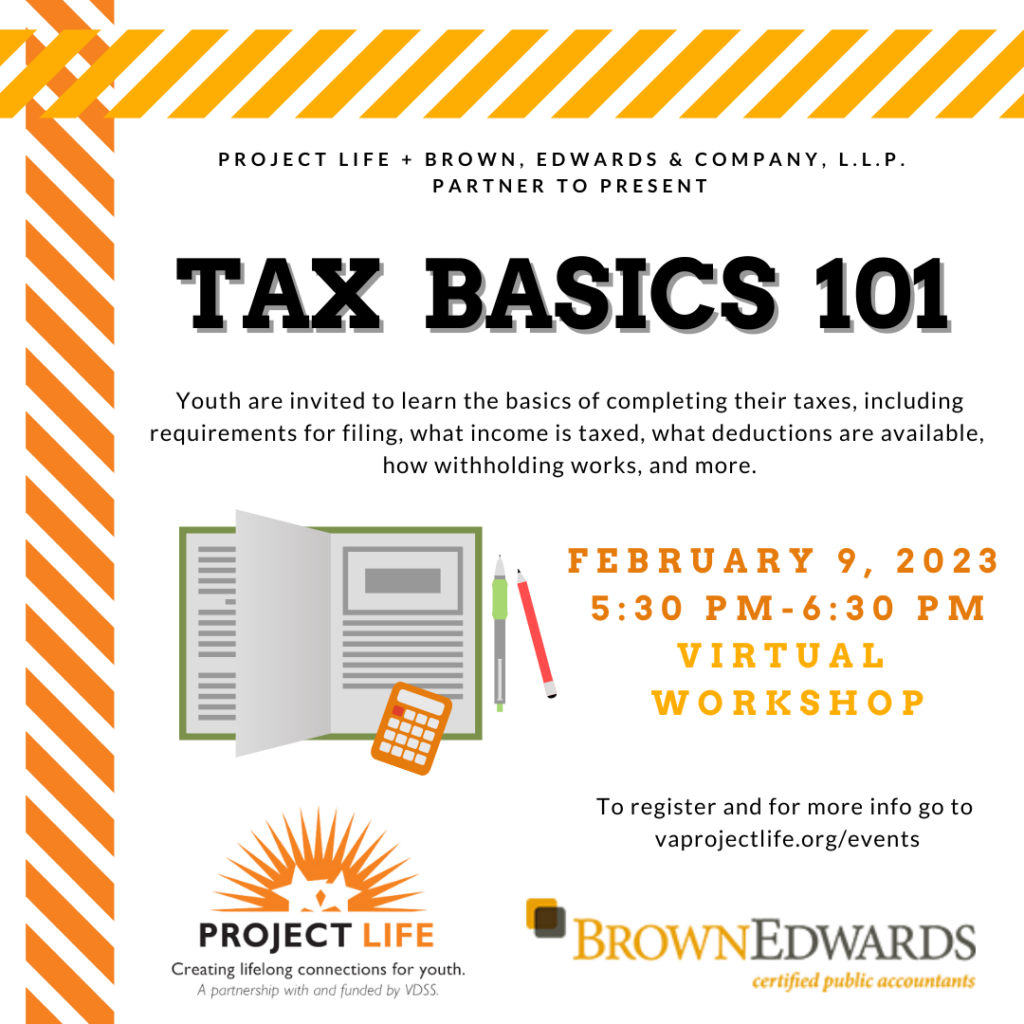

Virtual Session with CPAs (Certified Public Accountants)

We’re hosting a session with Brown, Edwards, and Company LLP on 2/9/2023 about the basics of filing taxes.

Here is a copy of the 2023 presentation available to download in a PDF. Click the button below to get a copy.

Tax Terminology

We’ve compiled a glossary for you to reference as you dive into your taxes. You can download it here.

Tax Return Deadline

The deadline to file your federal taxes is usually April 15 of each year, unless the IRS states otherwise. For example, in 2022 the deadline was adjusted to April 18 because April 16 is a holiday and falls on a Saturday, so IRS and other offices will be closed on Friday, April 15 so the holiday can be observed. The IRS starts accepting income tax returns on January 31 for the previous year. (Information credited to: chime.com)

For more information on taxes, visit: https://www.chime.com/blog/basic-tax-terms-you-should-know/#tax-terminology:-why-it-matters

Tax Videos from Outside Sources

Taxes for Teenagers and Young Adults – Taxes 101 for beginners

Teens ‘n Taxes What’s a W-4 form?

Taxes: Crash Course Economics #31